Retirement Savings Plan

The retirement of your dreams is within your reach, if you start saving today. We can help with a retirement plan that meets your future needs.

The retirement of your dreams is within your reach, if you start saving today. We can help with a retirement plan that meets your future needs.

The retirement of your dreams is within your reach, if you start saving today. We can help with a retirement plan that meets your future needs.

The sooner you start saving for life after work, the better. With a Metropolitan Retirement Savings Plan you can avoid the stress of not having enough money when your normal work life comes to an end.

The Metropolitan Retirement Savings Plan is our retirement savings solution, and anyone can use it. It's a disciplined way to save extra money for retirement if you work for an employer, or if you're self-employed.

Start saving from R300 a month.

Save for your retirement independently from your employer.

Two-thirds of your payment is invested in a retirement pot.

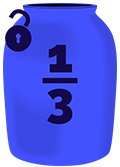

One-third of your payment is invested in a savings pot.

In case of a financial emergency, you’re allowed one withdrawal from your savings pot during a tax year.

Your retirement savings are protected from creditors.

When you take out a Metropolitan Retirement Savings Plan, you become a member of the Metropolitan Life Retirement Annuity Fund.

This retirement savings plan can help you save for your future. One of the main advantages is that your money stays in the fund until you reach retirement age, ensuring you have money available when you retire. Plus, your plan and your savings won’t be affected even if you change jobs.

The Metropolitan Retirement Savings Plan is compliant with the Two-Pot Retirement System and your retirement savings will be invested in a Retirement Pot and a Savings Pot.

If you had retirement savings, e.g. with another financial services provider, before 1 September 2024, and you transfer it to a Metropolitan Retirement Savings Plan, this money will be invested into a Vested Pot. In certain instances, we will divide your retirement savings between a Vested Pot, a Savings Pot and a Retirement Pot.

Before 31 Aug ‘24

10% of your existing retirement savings or R30000, whichever is the lowest, will be transferred to the Savings Pot.

The balance will be protected, and the Two-Pot rules will not apply to it.

Access to your money

You cannot take any money from this pot before you turn 55. However, there are some events where this rule does not apply. Becoming permanently disabled and unable to work is one of them.

After 1 Sep ‘24

One-third of your retirement contributions will go into your Savings Pot.

You can tap into this pot once every tax year, but it’s best to use withdrawals only for financial emergencies.

Access to your money

You must have a minimum of R2000 saved in this pot before you can make a withdrawal. Remember, you will be taxed, at your marginal tax rate and pay admin fees when you make a withdrawal.

After 1 Sep ‘24

Two-thirds of your contributions will go into your Retirement Pot.

Access to your money

This money will be locked into your Retirement Pot until you turn 55 and must be used to buy a retirement income plan when you retire. However, we may reconsider this rule if you become permanently disabled and are unable to work.

Contact us and we’ll guide you through the process and advise you on the documents you will need when submitting your claim.

If you belonged to the Metropolitan Retirement Annuity Fund before 1 September 2024 you can use our Chatbot to check if you are eligible to make a withdrawal.

0860 724 724

If you have no dependents, we pay out to your beneficiaries. If you have no beneficiaries, we pay the money to your estate.

The retirement fund's trustees must first consider dependents over other people even if you have named one or more beneficiaries. After investigating the circumstances, the retirement fund’s trustees pay out your retirement savings benefit.

The beneficiaries you named on your plan must submit a claim when you pass away. It’s important to tell people you have named them as your beneficiaries. Let them know where you keep this information so that they can contact us if you pass away.

You can choose to leave your money to a beneficiary or more than one. Beneficiaries may also be dependents.

The law describes your dependents as:

An unclaimed benefit is when Metropolitan expects to pay a claim but can’t do so because it can’t find the people who should get the money (your beneficiaries, dependents or your estate). Metropolitan will then invest the unclaimed benefit, as it deems appropriate, until such time as beneficiaries, dependents or your estate validly claims the unclaimed benefit.

You use a retirement savings plan to save money throughout your working life, to provide for your needs when you stop working. When you retire, this money is invested to give you an income in retirement. There are certain rules and requirements that tell you what you can do with this money, depending on the retirement plan you chose.

A retirement plan can help maintain your lifestyle after you stop working – even as living costs increase. The sooner you start saving, the better.

In the midst of the pandemic, I wanted to get my affairs in order. I made my daughter enter my details online, hoping someone would call me back to update my polices, which are almost 28 years old. I didn't have much hope. Until Sam from Metropolitan called me and assisted me over one weekend. He was professional and courteous. My only regret is that we did not cross paths sooner.

I seldom experience the kind of 5-star client service I received from Metropolitan, days after my beautiful mother passed from Covid complications. I can proudly say you treated me and those around me with dignity, love and respect. When I thanked the consultant, Alfred, he said "We are family". It felt like he was acknowledging my mother as his mother too. She would have loved that.

I was contacted by a wonderful young woman by the name of Kaylinn Smith, a financial adviser at Metropolitan. She did an absolutely great job selling me one of their products. And the best part is that I never felt obligated or under pressure to sign up with her. She made me feel like I was in charge all the time. I will recommend her anytime, to anyone.

You may request that your personal information held by Metropolitan be removed.

Please note that you will be contacted with regards to this request; as there may be other applicable laws that may prevent your data from being deleted.