The importance of life cover

Share on

We all want those we love to be taken care of when we pass away. Whether it is to provide them with enough money to take care of their daily needs, or to repay a loan, life cover allows us to achieve this goal. The uncertain times introduced by the COVID-19 pandemic has focused everyone’s attention on the reality that we need to make provision for the ones we love upon our passing.

The Metropolitan Life Cover Plan (MLCP) is Metropolitan’s latest limited underwritten solution that can help you achieve this goal. This solution offers up to R1 million life cover and various other excellent benefits and features. One of the features is the opportunity to choose between a level and increasing premium payment pattern to suit your needs.

Level vs. Increasing payment pattern

Metropolitan introduced the option for you to select an increasing premium payment pattern with its Metropolitan Life Cover Plan. This option offers you the opportunity to choose whether you want to pay a level premium over the lifetime of your policy, or have your premium increase by 4% every year up to age 60.

Why choose an increasing premium?

An increasing premium payment pattern allows you to start with a lower monthly premium that increases annually. This makes the insurance solution more affordable at the start of the policy. Your salary is expected to increase over time, and this will allow you to increase the amount you pay.

Premiums on the Metropolitan Life Cover Plan will increase by 4% per year up to age 60. Thereafter, your premiums become level with no further increases. This reduces the strain of paying increasing premiums when you retire and have a fixed income from age 60. From age 85, Metropolitan will pay all future premiums on your behalf. This is just another way in which Metropolitan is saying, ‘Together we can’.

Why choose a level premium?

A level premium payment pattern means that your premiums will not increase over the lifetime of the contract. You will pay the same amount until you are 85. If you can afford to pay the level premium now, it should become easier to afford the premium in the long term as your salary is expected to increase over time. Metropolitan will pay your premiums from age 85.

Which is better?

At Metropolitan you can choose between level and increasing premium payment patterns; while many other financial service providers only offer increasing premium so that you pay a reduced premium at the start of the policy contract. However, a level premium payment pattern may be your better option, even if the initial premium is higher. You need to consider your circumstances to determine which premium payment pattern suits you best.

It is important to consider the premium that is payable over the whole term of the contract rather than just making a comparison at the start of the policy. You also need to pay careful attention to the full terms and conditions of the increasing premium payment pattern to ensure you understand how this affects future premiums. The example below illustrates the vast difference that the terms of the increasing payment pattern can have on future premiums payable under the contract.

Example: Metropolitan increasing premium vs competitor increasing premium

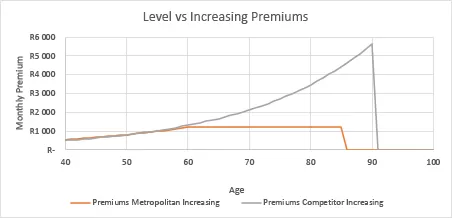

The graph above shows how the increasing premium changes over time for the Metropolitan Life Cover Plan and how this compares to a competitor’s offering. The premiums quoted are for a 40-year-old woman who is taking out R1 million life cover. It is worth noting that a similar trend will generally be observed for men, different ages and for different life cover amounts.

Metropolitan's increasing premium starts at R547 and increases by 4% per year up to age 60. Thereafter, the client pays R1199 per month from age 60 to 85. At age 85, this premium reduces to R0 as Metropolitan will pay the future premiums.

Competitor A's increasing premium starts at R517. This is lower at the outset, but the premium increases by 5% per year. Their first increase is at the start of the third year. Their increases do not stop at age 60, but rather continue up to age 90 and clients need to keep paying up until then. Therefore, the client will pay R5 646 per month at age 90, which is a lot more than they would’ve paid at Metropolitan (as can be seen in the graph above). Competitor A’s lower initial premium only benefits the client up to age 51. Thereafter, the premiums are higher and continue to increase faster.

This shows that it is important for the client to compare the premium over the whole term of the contract, not only at the outset.

If you're considering getting life cover, speak to a qualified Metropolitan financial adviser who will help you plan for and achieve your financial goals, setting you up for a better future.

by Luke Nel

*Luke Nel is a Metropolitan actuarial specialist who is involved in product development and the pricing for risk solutions.